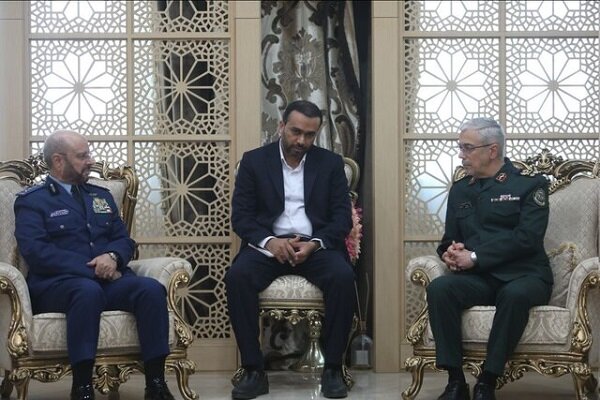

General chief of staff of Saudi Arabia’s armed forces, General Fayyadh al-Ruwaili, and his Iranian counterpart, Major General Mohammad Baqeri, in Tehran.

“We are interested in having the Saudi navy in the coming year participate in a naval exercise with Iran, either with its naval units or as an observer.”

Iran and Saudi Arabia’s defense ties grow despite Donald Trump winning the 2024 U.S. presidential election—known for his maximum pressure strategy on Tehran. According to the semi-official media outlet Iranian Students’ News Agency (ISNA), on 10 November, the general chief of staff of Saudi Arabia’s armed forces, General Fayyadh al-Ruwaili, met with his Iranian counterpart, Major General Mohammad Baqeri, in Tehran, where they discussed “the development of defense diplomacy and the expansion of bilateral cooperation.”

According to the excerpted article from the semi-official news outlet Mehr News Agency, during the meeting, Major General Bagheri also invited the Saudi defense minister to visit Iran and said Tehran is “interested in having the Saudi Navy participate in a naval exercise with Iran in the coming year, either with its naval units or as an observer.” The countries recently participated in a joint naval exercise with Russia and Oman, as well as five other observer countries—among those Saudi Arabia—in the Sea of Oman.[i] General Bagheri is the second high-ranking Saudi official to visit Iran after Foreign Minister Faisal bin Farhan visited in June 2023.[ii]

The storming of the Saudi missions in Tehran and Mashhad following the execution of prominent Shia cleric Nimr al-Nimr in January 2016 prompted Saudi Arabia to sever ties with Iran.[iii] In the years since, particularly under the Trump administration, Riyadh had taken a harder stance against Tehran. After the 2019 Aramco attacks, Saudi Arabia felt vulnerable due to Iran-backed attacks, which the administration failed to address. This led to a reassessment of its approach to Tehran and a de-escalation of tensions. It was not until a China-brokered deal in March 2023 that the two neighbors recommenced relations with the reopening of embassies in their respective countries.[iv] According to the Mehr News Agency article, Ruwaili called the Beijing deal “a good basis for increasing bilateral work together between the two countries,” noting that Riyadh considers “this agreement as a strategic opportunity.”

The rare Saudi visit to Iran demonstrates that rapprochement will continue despite a new U.S. administration that is expected to resume its maximum pressure strategy on Tehran. Iran’s “neighborly policy” of improving ties with its Arab neighbors appears to be paying off for now.

Sources:

“رئیس ستاد کل نیروهای مسلح عربستان با سرلشکر باقری دیدار کرد (Saudi Arabia’s chief of staff of the armed forces met with Major General Bagheri),” Iranian Students’ News Agency (ISNA; semi-official news agency), 13 November 2024. isna.ir/xdSfrg

General Fayyadh bin Hamed al-Ruwaili met with the chief of staff of the armed forces. According to ISNA, quoting the public relations office of the general staff of the armed forces, General Fayyadh bin Hamed al-Ruwaili, [Saudi] chief of staff of the armed forces, met and talked with Major General Mohammad Bagheri, the[ Iranian] chief of staff of the armed forces.

The development of defense diplomacy and the expansion of bilateral cooperation are among the main topics of this meeting.

Today at noon, the Saudi chief of staff of the armed forces arrived in Tehran as the head of a high-ranking military delegation.

“همکاریهای دوجانبه دفاعی و نظامی ایران و عربستان بررسی شد (The bilateral defense and military cooperation between Iran and Saudi Arabia was reviewed),” Mehr News Agency (semi-official news outlet), 13 November 2024. mehrnews.com/x36rn3

Major General Mohammad Bagheri, after greeting and welcoming, said: “We believe that cooperation between the armed forces of the two countries, given numerous commonalities and abundant potential, can increase.”

The chief of staff of the armed forces of Iran emphasized improving cooperation in the fields of defense and exchanging experiences in the education and sports sectors, adding: “We are interested in having the Saudi navy in the coming year participate in a naval exercise with Iran, either with its naval units or as an observer.”

Examining the improvement of bilateral defense and military cooperation and the Palestine issue was among the topics that were part of the parties’ discussion.

Army General Fayyadh bin Hamed al-Ruwaili, at the time of thanking for the hospitality of the chief of staff of the armed forces, highlighted and emphasized the improvement of the level of cooperation in various fields in the armed forces of the two countries and stated: “The Bejing agreement was a good basis for increasing bilateral work together between the two countries and we consider this agreement as a strategic opportunity.”

He also emphasized the importance of the two countries’ role-playing and influence in uniting the Islamic and regional countries and the continuation of political and defense relations between the two countries.

At the end, Major General Mohammad Bagheri invited the Saudi defense minister to visit Iran.

Notes:

[i] “Iran and Saudi Arabia hold joint naval exercise in Sea of Oman,” Times of Israel, 24 October 2024. https://www.timesofisrael.com/iran-and-saudi-arabia-hold-joint-naval-exercise-in-sea-of-oman/

[ii] Amir Vahdat, “Saudi foreign minister in Iran as part of restoration of diplomatic ties after a 7-year rift,” Associated Press, 17 June 2024. https://apnews.com/article/saudi-arabia-iran-c04f4483f660c65229535ae80083dbd6

[iii] “Saudi Arabia breaks off ties with Iran after al-Nimr execution,” BBC News, 4 January 2016. https://www.bbc.com/news/world-middle-east-35217328

[iv] “What You Need to Know About China’s Saudi-Iran Deal,” United States Institute of Peace, 16 March 2023. https://www.usip.org/publications/2023/03/what-you-need-know-about-chinas-saudi-iran-deal

Image Information:

Image: General chief of staff of Saudi Arabia’s armed forces, General Fayyadh al-Ruwaili, and his Iranian counterpart, Major General Mohammad Baqeri, in Tehran,”.

Source: mehrnews Mehr News Agency (semi-official news outlet), 13 November 2024, com/x36rn3

Attribution: CCA-SA 4.0 Intl.

.jpeg)